In the realm of financial planning, Index Universal Life (IUL) insurance stands out as a versatile and powerful tool. It combines the benefits of life insurance protection with the potential for cash value growth linked to stock market indexes, offering a unique blend of security and opportunity. In this guide, we’ll delve into what Index Universal Life is, why it’s valuable, and why you might need it.

Understanding Index Universal Life Insurance

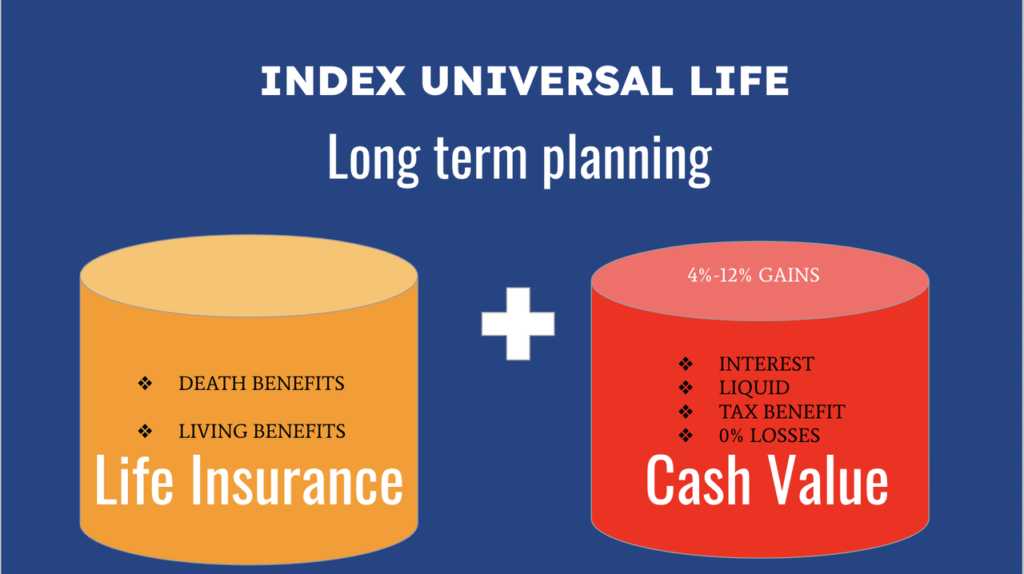

Index Universal Life insurance is a type of permanent life insurance that provides a death benefit to your beneficiaries while also building cash value over time. What sets it apart from traditional whole life insurance is its ties to market indexes like the S&P 500. Rather than offering fixed interest rates, IUL policies allow you to earn interest based on the performance of these indexes, subject to certain caps and floors.

The Benefits of Index Universal Life

- Death Benefit Protection: Like all life insurance policies, IUL provides a death benefit that pays out to your beneficiaries when you pass away. This financial protection can be crucial for providing for your loved ones in your absence.

- Tax-Advantaged Growth: The cash value component of an IUL policy grows tax-deferred. This means you won’t pay taxes on the gains as long as the money stays within the policy, offering potential savings and compound growth opportunities.

- Market Participation with Protection: Unlike direct stock market investments, where you bear all the risk, IUL policies typically come with a floor that protects your cash value from market downturns. At the same time, you can benefit from market upswings up to a certain cap, providing a balance between growth potential and downside protection.

- Flexible Premiums and Benefits: IUL policies often offer flexibility in terms of premiums and death benefits. You can adjust your premium payments and death benefit amounts within certain limits, allowing you to adapt to changing financial circumstances.

- Living Benefits and Withdrawals: Some IUL policies offer living benefits such as loans or withdrawals against the cash value. These can be useful in times of need, providing access to funds without surrendering the policy.

Why You Might Need Index Universal Life Insurance

- Long-Term Financial Planning: If you’re looking for a long-term financial strategy that combines life insurance protection with investment potential, IUL can be a valuable component. It can help you build wealth over time while ensuring your loved ones are financially secure.

- Tax-Efficient Retirement Income: The tax-deferred growth and potential tax-free withdrawals in retirement make IUL attractive for individuals seeking tax-efficient income sources during their golden years.

- Legacy Planning: IUL can be used as part of an estate plan to leave a legacy for your heirs. The death benefit can provide a tax-free inheritance, and the cash value can be accessed for wealth transfer or charitable giving.

- Supplemental Retirement Savings: For those who have maxed out other retirement accounts or want additional savings diversification, IUL offers a way to accumulate funds for retirement beyond traditional options.

- Protection Against Market Volatility: The downside protection of IUL can appeal to investors wary of market volatility but still seeking growth opportunities tied to market performance.

Conclusion

Index Universal Life insurance combines the best of both worlds: life insurance protection and potential market-linked growth. Whether you’re planning for retirement, safeguarding your family’s future, or looking for tax-efficient wealth accumulation, IUL can be a valuable tool in your financial toolkit. It’s important to work with a knowledgeable financial advisor to understand the specifics of IUL policies, including costs, risks, and benefits, to determine if it aligns with your goals and needs.

Leave a Reply